#and the trendline is exponential

Explore tagged Tumblr posts

Text

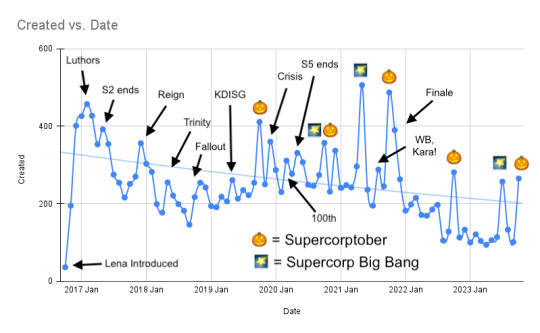

💗 7 years of supercorp fics 💗

It's been a little over 7 years since Lena came into Kara's life. This immediately prompted the first supercorp fic and has led to tens of thousands more. Despite the show ending two years ago, supercorp has had some massive staying power (look at that trendline!) and become the biggest F/F ship on AO3.

Something tells me we're going to be creating for a good long time 💪(Including me. If you'd like, read my supercorptober ficlet-turned-oneshot, Echoes of the Forest!)

#if anyone wants the boring details I used the “created_at” tag on AO3#I was also logged in so this includes all registered-user-only fics#and the trendline is exponential#labels and arrows and emoji were manually done because I'm a masochist#this image ended up tinier than I expected. needs more jpg.#supercorp#supercorptober#supercorp big bang#mel stuff#sg musings#fic stats

306 notes

·

View notes

Text

Excel really can just do anything huh

#makes my life easier bless#I can’t for the life of me figure out how to find a trendline using multiple data points though#like yeah you can just take two if the line is linear#and you can use other functions for exponential growth and decay#but what about averaging trendlines?? when you have multiple data points that don’t have a singular linear or exponential function??#how does it do that???#I thought maybe it just averaged the results of the slope and calculated it based on that#but I tried replicating it and it didn’t work#the internet won’t tell me either#sigh idk I haven’t done math in a while so maybe I learned this and just forgot#oh excel…you work in mysterious ways#math#cw math

0 notes

Text

"History is doomed to repeat itself". It always didnt sit right to me. Time to ask myself why and walk through my thoughts

The concept of time really confuses people (as it should), and any science fiction that is showing things like time travel arent really helpful.

Time is fluid in a sense, yes. But its important to note that while we are all stuck on a firey, warming hellscape known as colonizer Earth-- for all intents and purposes for the next 50 years on mortal, warming earth, time is extremely fixed +/- 1 second/yr nuance for really big heavy things on earth

When I'm talking about us mortals stuck on mortal earth-- No, I'm not talking about "Rich men shoot off to space and watch us from their ships" type people. Because 1) I dont count them as a real, feeling human beings while they dont treat me as one (fairness). Those people are monsters trying to abandon the poor in sake of something for only themselves. And 2) time will start behaving differently in space than on Earth, and those differences in technical maths can be a distraction for real Earth issues

What do I mean it can be a distraction? Well.. science that promotes ignorance & bliss under capitalism is mostly the science that gets propogated is what I'm saying. Like trying to convince people a wormhole 5ft wide could appear in front of them and watching people fail to understand time from that confusing, none realistic lens

Time is 1 second. If its been a minute thats an accumulation of 60 seconds. A year is ~525,600 minutes. 100 years is literally 50 million minutes. One after another and only in that direction. During that time, every single person on this Earth felt the effects of that minute the same we do today

There are a measurable, estimatable amount of collected minutes that this earth has been around. As hard as that is to grasp fully since it would be a DAMN lot of minutes. Imagine the 1990s cell bill Earth would get

Likewise, I get frustrated a lot by the mentality that "history repeats itself". I really think people confuse feedback-effect cycling with time accumulation effects and its not at all the same thing

Political idealogical cycles represent a feedback effect. It plays into my argument about "self-destructive vs self-promoting" behavior.

The place where time comes into the argument is only for the trendline of the cycle. This trendline, time, represents an accumulation of all collective learning which has ever happened in history.

Once a collective learns something, there is no going back on that science unless all the believers of it are murdered in cold blood by genociding colonizers

This is your friendly reminder that it is defeatest, self-destructive mentality to say "history is doomed to repeat itself".

Nope. You just love being a negative nelly who votes against progressive change and is observing the world devolving from those actions on a much smaller timeframe than human development has trended these social concepts exponentially upward

"Narrow minded" I guess is fitting here

3 notes

·

View notes

Text

The Schaff Trend Cycle & Bearish Flag: The Secret Weapon for Timing Market Reversals The Hidden Formula That Separates the Pros from the Amateurs Trading is a battlefield, and if you’re stepping into the market unarmed, you’re as good as a foot soldier in flip-flops. Most traders rely on the usual suspects—RSI, MACD, and moving averages—but real pros know that market timing is everything. Enter the Schaff Trend Cycle (STC) and the bearish flag—a killer combination that can help you pinpoint market reversals before the herd even notices the trend shift. If you’ve ever felt like your trades get stopped out just before the real move happens, or you enter too late when the party’s already over, then this article is your VIP pass to timing precision. Let’s dive deep into how these two indicators work together to keep you ahead of the pack. The Schaff Trend Cycle: The Market Whisperer You Never Knew You Needed Most traders have heard of the MACD (Moving Average Convergence Divergence). It’s useful, but it’s also notorious for lagging—like trying to catch a bus that already left. The Schaff Trend Cycle (STC) is like MACD’s smarter, faster cousin. Developed by Doug Schaff, this indicator is an advanced form of the MACD that uses a cycle component to filter out noise and generate signals earlier than traditional oscillators. How It Works: - It’s based on MACD principles – STC utilizes exponential moving averages to identify trends but improves on MACD by reducing lag. - It incorporates a cycle component – Instead of relying solely on price action, it factors in the market’s cyclical nature, giving early warnings for trend reversals. - Faster buy and sell signals – Because it combines trend and cycle analysis, STC delivers signals well before traditional oscillators like the RSI or Stochastic. Think of STC as a GPS that recalculates in real-time, keeping you updated on the best market exit and entry points before others even realize a change is happening. The Bearish Flag: The Market’s Sneaky Trap Picture this: You see a strong downward move (the flagpole), followed by a slight consolidation that moves upward (the flag). Many traders mistakenly think this is a reversal—but in reality, it’s a trap. The bearish flag is a classic continuation pattern, signaling that a deeper plunge is on the way. Spotting a Bearish Flag in the Wild: - Sharp downward move (the flagpole) – This is a steep drop, often accompanied by high volume. - Consolidation period (the flag) – Price moves upward or sideways, but at a weaker pace and with decreasing volume. - Breakdown confirmation – Once price breaks below the lower boundary of the flag, it signals a continuation of the downtrend. The mistake most traders make? They assume the consolidation is a reversal and buy too early—only to watch price nosedive like a bad investment in penny stocks. How to Use the Schaff Trend Cycle with the Bearish Flag Like a Pro Now that you understand how these two indicators work, let’s combine them into an elite-level strategy that can dramatically improve your timing and profitability. Step 1: Identify a Bearish Flag - Look for a strong downward move followed by a consolidation phase. - Pay attention to volume—the initial drop should have high volume, and the flag should have lower volume. - Draw trendlines around the consolidation zone to identify the breakout level. Step 2: Confirm with Schaff Trend Cycle - If the STC is above 75 and crossing downward, it confirms bearish momentum. - If STC crosses below 25, it signals oversold conditions, which means you may want to start looking for an exit. - Avoid false signals—use the STC in combination with price action to confirm your trade. Step 3: Execute with Precision - Entry: Enter short when price breaks below the flag with high volume. - Stop-loss: Place your stop-loss just above the consolidation high to minimize risk. - Profit Target: Measure the flagpole length and subtract it from the breakout level to estimate your price target. Real-World Example: The GBP/USD Bearish Flag Breakdown In mid-2023, GBP/USD formed a textbook bearish flag after a sharp decline due to poor UK economic data. Many traders assumed the flag was a reversal and bought in too early. However, those who used the Schaff Trend Cycle saw the hidden clues: - STC was in the overbought zone and started to turn down. - Price consolidated in a weak uptrend with declining volume. - A breakdown occurred, and GBP/USD dropped another 300 pips. Those who blindly bought into the flag lost big, while traders who waited for STC confirmation bagged solid profits. Why This Strategy Works (And Why Most Traders Ignore It) Most retail traders focus solely on price action, ignoring momentum confirmation from indicators like the STC. Here’s why this combination is powerful: - Reduces false breakouts – STC acts as a second layer of confirmation. - Improves timing – You enter the trade before the big move happens. - Works across multiple timeframes – Great for intraday traders and swing traders alike. Final Thoughts: Your New Secret Weapon in Forex Trading Mastering the Schaff Trend Cycle and the bearish flag can give you an edge over 90% of traders who rely solely on outdated indicators. By using these tools together, you’ll: ✅ Spot reversals early ✅ Filter out bad trades ✅ Ride powerful market moves with confidence If you want to take your trading to the next level, check out these expert resources: 📈 Live Market Insights – Stay ahead with real-time Forex updates 📚 Free Forex Courses – Upgrade your trading knowledge 👥 Join the Community – Get daily alerts and insider tips 📊 Free Trading Plan & Journal – Optimize your strategy 🤖 Smart Trading Tool – Automate your trading decisions —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Bitcoin, Ethereum, Ripple: Imminent Correction and Potential Trend Shakeup in Cryptocurrency Markets

Key Points

Bitcoin, Ethereum, and Ripple have successfully defended crucial short-term support levels.

The US Federal Reserve’s recent 0.25% interest rate cut and 2025 hawkish projection triggered a decline in Bitcoin’s value.

Bitcoin, Ethereum, and Ripple, three major digital assets, have managed to defend their short-term support levels against a backdrop of declining values. This comes in the wake of the US Federal Reserve’s recent 0.25% interest rate cut and its hawkish projection for 2025, which led to a drop in Bitcoin (BTC)‘s price to $100K.

Bitcoin’s Defense and Potential Rebound

Since the 12th of December, Bitcoin bulls have been defending the $100K mark, with the sell-off following the recent Federal Open Market Committee (FOMC) meeting easing at this psychological level, thereby confirming it as a support. The 100-day EMA (exponential moving average), which has halted past Bitcoin dumps since October, aligned with the channel lows, making the $98K-$100K range a strong short-term support for Bitcoin.

If this support holds, the mid-range of $104K and upper level of $108K-$109K could be achievable. However, a breach below the support could lead to further decline, making $90K and $85K reachable for bears. The recent decline was also driven by a liquidity hunt, which was currently concentrated at $102.5K, $105K, and $108K levels.

Ethereum and Ripple’s Price Predictions

Ethereum, the leading altcoin, has been consolidating between $3.5K and $4K since the start of December. Similar to Bitcoin, it dropped from $4.1K but bounced at the $3.5K range-lows. If the range-low holds, a move higher to $3.7K and $4K could be possible. However, if the channel’s support cracks, Ethereum bears could pull the altcoin down to $3.3K or $3.1K.

Despite a 10% drop, Ripple held above its Q4 trendline support and could be the key level to watch for the rest of 2024. Bulls could aim for a $2.8 level or push higher to the 2021 cycle high of $3.3 using the support as a springboard. However, a crack below it could empower short sellers to push Ripple lower to $2 or $1.6.

Despite defending key levels, the potential market trend reversal to the upside for these top cryptocurrencies could be affected by likely low trading volume during the Christmas period.

0 notes

Link

XRP finds itself at an important juncture, because it eyes $0.53 to interrupt above the higher trendline of a month-long symmetrical triangle, with the bears looking for to push costs additional under.XRP is at the moment buying and selling at $0.5029. This worth degree locations it beneath the 50-day Exponential Shifting Common (EMA) at $0.5298 and the 200-day EMA at $0.51970. These shifting averages function key market sentiment indicators and potential pattern reversals. Buying and selling under each essential shifting averages alerts bearish sentiments within the brief and lengthy phrases.XRP In a Symmetrical Triangle For the previous month, XRP has remained throughout the confines of a symmetrical triangle, a sample that always signifies market indecision. – Commercial –This formation has captured the eye of each bulls and bears, with every camp vying for management. On Sept. 11, the bears made a valiant try to push XRP under the decrease trendline of the triangle. XRP Symmetrical Triangle | TradingViewThis stress from the bears led to a three-week low of $0.4590, with additional dips on the horizon. Nonetheless, XRP demonstrated resilience, getting back from this downward stress and staging a exceptional comeback.Conversely, final week witnessed a surge in XRP’s worth to $0.5256, momentarily retesting the higher trendline of the symmetrical triangle. Sadly for the bulls, resistance from the bears introduced XRP again into the triangle’s embrace. Presently, XRP is following a mildly downward trajectory, portray an image of uncertainty available in the market. A big issue contributing to this uncertainty is the shortage of considerable updates concerning the battle between Ripple and the U.S. SEC. A Pivotal LevelXRP should overcome just a few vital hurdles to chart a bullish course ahead. Reclaiming and surging past the $0.52 worth level could be promising. This transfer would once more take a look at the higher trendline, doubtlessly opening the door to additional features. Breaking above the psychological resistance at $0.51 and establishing supremacy over the 200-day EMA may signify the power required for XRP to make a convincing transfer above $0.52.But, the trail upward is just not with out its challenges. XRP at the moment grapples with a downward slope, demanding vigilance from the bullish camp. The bulls should staunchly defend the $0.48 degree to stave off potential losses. A breach under this level may spell bother, main XRP under the decrease trendline and doubtlessly setting $0.45 as the following goal for the bears.XRP TechnicalsDigging deeper into the technical indicators, the Relative Power Index (RSI) on the each day timeframe presents some intriguing knowledge. XRP Each day RSI | TradingViewPresently at 45.50, the RSI signifies a market that isn’t decisively bullish or bearish. Concurrently, the RSI-based Shifting Common (MA) line, standing at 43.24, suggests a gentle enhance, hinting at a possible shift in momentum favoring the bulls.The Shifting Common Convergence Divergence (MACD) indicator provides one other perspective. Over the previous few weeks, the MACD Line (blue) has been on an upward trajectory, sustaining its place above the Sign Line (yellow). XRP Each day MACD | TradingViewThis configuration is commonly seen as a bullish sign, suggesting the potential for continued constructive worth motion for XRP. In the meantime, commerce quantity for XRP has elevated by 30% over the previous 24 hours, sitting at $488 million. This alerts a re-entry of market individuals.Comply with Us on Twitter and Fb.Disclaimer: This content material is informational and shouldn't be thought-about monetary recommendation. The views expressed on this article might embrace the creator’s private opinions and don't replicate The Crypto Fundamental’s opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental is just not liable for any monetary losses.-Commercial-Supply: https://thecryptobasic.com/2023/09/25/xrp-at-a-pivotal-point-bulls-need-to-defend-0-48-to-break-above-month-long-symmetrical-triangle/?utm_source=rss&utm_medium=rss&utm_campaign=xrp-at-a-pivotal-point-bulls-need-to-defend-0-48-to-break-above-month-long-symmetrical-triangle

0 notes

Text

Understanding Know Sure Thing (KST) Indicator: A Comprehensive Guide

The Know Sure Thing (KST) indicator is a powerful technical analysis tool designed to identify trend changes and potential trading opportunities in financial markets. Developed by Martin J. Pring, a renowned technical analyst, KST combines several moving averages and smoothing techniques to generate signals that help traders gauge momentum and market direction. This article explores the principles behind the KST indicator, its components, interpretation methods, and practical applications in trading.

Introduction to Know Sure Thing (KST)

Know Sure Thing (KST) is a momentum oscillator that measures the rate of change in price movements across multiple timeframes. Unlike traditional oscillators that focus on price data alone, KST incorporates various moving averages and smoothing techniques to provide a more holistic view of market momentum. The indicator aims to filter out short-term noise and highlight significant trends, making it particularly useful for identifying trend reversals and confirming market trends.

Components of Know Sure Thing (KST)

The KST indicator consists of four components, each contributing to its calculation and interpretation:

Rate of Change (ROC): The ROC component measures the momentum of price changes over multiple periods. It calculates the percentage change in price from one period to another, smoothing out fluctuations to identify long-term trends.

Moving Averages (MAs): KST uses four different exponential moving averages (EMAs) of the ROC values calculated over different timeframes. These EMAs include shorter-term and longer-term averages, each weighted to reflect recent price movements while maintaining sensitivity to longer-term trends.

Smoothing Factors: To further refine its signals, KST applies two levels of smoothing: a standard EMA smoothing for each ROC value and a final EMA smoothing across the four resulting EMAs. This double smoothing process reduces noise and enhances the clarity of trend signals.

Signal Line: The KST indicator also includes a signal line, typically represented as a simple moving average (SMA) of the final smoothed KST values. This line acts as a trigger for buy or sell signals based on crossovers with the KST line.

Interpreting Know Sure Thing (KST) Signals

Crossovers: The primary signals generated by KST are based on crossovers between the KST line and its signal line. A bullish crossover occurs when the KST line crosses above the signal line, indicating increasing momentum and potential buy opportunities. Conversely, a bearish crossover signals a decrease in momentum and potential sell opportunities.

Divergence: Divergence between the KST line and price movements can also provide valuable signals. Bullish divergence occurs when the KST line forms higher lows while prices form lower lows, suggesting underlying strength and potential price reversal to the upside. Bearish divergence, on the other hand, occurs when the KST line forms lower highs while prices form higher highs, indicating potential weakness and a possible downturn.

Overbought and Oversold Conditions: Although KST does not have traditional overbought or oversold levels like other oscillators, extreme deviations from its baseline or signal line can indicate potential exhaustion in buying or selling pressures. Traders may interpret these extremes as signals to consider taking profits or anticipating trend reversals.

Practical Applications of Know Sure Thing (KST)

Trend Confirmation: KST is often used to confirm the strength and direction of market trends identified through other technical analysis tools, such as moving averages or trendlines. A rising KST line above its signal line supports bullish trends, while a declining KST line below its signal line confirms bearish trends.

Signal Validation: Traders integrate KST signals with other indicators or chart patterns to validate trading decisions. For instance, a bullish crossover on KST combined with a breakout above resistance levels enhances the probability of a successful long trade.

Risk Management: Incorporating KST signals into risk management strategies helps traders set stop-loss levels and adjust position sizes based on the strength of trend signals. Tightening stops during strong bullish trends or reducing exposure during bearish crossovers can protect capital and optimize returns.

Limitations of Know Sure Thing (KST)

Whipsaws: Like other momentum oscillators, KST is susceptible to generating false signals during periods of choppy or sideways price movements. Traders should use additional confirmation tools to filter out false signals and minimize trading risks.

Market Conditions: KST performs best in trending markets where price movements exhibit clear directional biases. During volatile or range-bound conditions, its effectiveness in generating reliable signals may diminish, requiring adjustments in interpretation or signal thresholds.

Conclusion

The Know Sure Thing (KST) indicator is a versatile tool for technical analysts and traders seeking to identify trend reversals, confirm market trends, and optimize trading strategies. By integrating multiple moving averages and smoothing techniques, KST provides a comprehensive view of market momentum across different timeframes, enhancing decision-making processes. Understanding its components, interpreting signals, and applying practical strategies can empower traders to navigate financial markets with greater confidence and precision.

While KST offers valuable insights into market dynamics, its effectiveness depends on complementary technical analysis tools and risk management practices. By incorporating KST signals into a holistic trading approach, traders can capitalize on opportunities, manage risks effectively, and achieve consistent profitability in dynamic market environments.

0 notes

Text

Crypto markets warm up for recovery, BTC, and ETH leading the pack

The cryptocurrency market is displaying signs of recovery as most coins attempt to break out of descending trendlines and rebound from recent lows. Bitcoin (BTC) and Ethereum (ETH) are leading this recovery, trading around key support levels. Bitcoin faces resistance near $17,000, with a breakdown potentially leading to a correction towards $15,000. Ethereum, trading around $1,271.97, shows resilience with support holding firm between $1,214.10 and $1,284.22.

In technical analysis, BTC/USD is within a range of $16,200-$17,000, with upward-trending 20-day and 50-day exponential moving averages (EMA) hinting at a bullish outlook. Conversely, a break below $16,200 could signal a downtrend towards $15,000. ETH/USD, trading above both the 20-day and 50-day EMAs, suggests a short-term uptrend.

Despite the overall bearish sentiment, some altcoins are performing well, notably Trust Wallet (up 21.48%), XRP (up 9.35%), and Quant token (up 19.31%). Conversely, Convex Finance (CVX) and Kucoin Token (KCS) are among the worst performers, declining by over 4.0% and 3.84%, respectively.

While BTC and ETH lead the recovery, the market remains cautious, with further declines possible. However, a downside breakout could trigger increased selling pressure, pushing prices below current support levels. Monitoring key levels closely is essential for making informed trading decisions amidst ongoing market uncertainty.

0 notes

Text

Bitcoin Price Drops as Market Correction and External Factors Cause Concern

The price of Bitcoin (BTC) has dropped by around 1.8% to as low as $41,860 on Feb. 1. This decline is part of a broader correction that started two days ago. The decline came after the price failed to break above a critical resistance level of $43,850. This drop can be attributed to several factors including the U.S. Federal Reserve's decision to maintain interest rates without any indication of a rate cut in the near future. This has had a negative impact on risk assets like Bitcoin. The outflows from the Grayscale Bitcoin Trust (GBTC) and concerns about the potential release of Bitcoin from the defunct Mt. Gox exchange have also contributed to fear and uncertainty in the market. The U.S. government's announcement to auction off a significant amount of Bitcoin has added to market apprehensions. Furthermore, miners selling their BTC holdings has added downward pressure on Bitcoin prices. Technical analysis suggests that Bitcoin's price correction started at a resistance level of around $44,000. If Bitcoin manages to hold above its 50-day exponential moving average (EMA), it could rebound towards $44,000. However, if the price breaks decisively below the 50-day EMA, there is a higher likelihood of a decline towards the lower trendline of the falling channel, which coincides with the 200-day EMA. It is important to note that the recent decline in Bitcoin's price may not have strong conviction behind it, as the volume bars don't show any significant increase in trading volume. The ongoing market situation indicates that Bitcoin's price could rebound in the coming days.

Read the original article here

Hashtags: #bitcoin #cryptocurrency #finance #investment

0 notes

Text

Supercorp Fic Trends

You may have seen the other version of this earlier, but in short, I was inspired by the femslash stats to dig into supercorp fics... and then I decided to go back to the beginning 🤣

(Numbers are using the created_at tag on ao3. Trendline is exponential, not linear.)

The fandom has varied pretty wildly since Lena's introduction in October 2016 - I'm actually surprised! There's definitely a downward trend, but it's pretty slow. Taking the full scope of the fandom into account... there's a lot of love for these characters, I think supercorp writers will be here for a good long time 💖 💪

... including me. With this nerdery done, I'm going back to polishing the next chapter of my worldkiller!Kara fic!

100 notes

·

View notes

Text

Trending Market: What it Means, How it Works

What Is a Trending Market?

A trending market, in the context of financial markets, refers to a situation where the price of a particular asset, such as a stock, commodity, currency, or cryptocurrency, is consistently moving in one direction over a period of time. This movement can be either upward (bullish trend) or downward (bearish trend), and it typically occurs due to various factors and market dynamics. In simpler terms, a trending market is one in which the price is steadily and persistently rising or falling over a significant period.

Key characteristics of a trending market include:

Directional Movement: In a trending market, the price of the asset consistently moves in a specific direction, either up or down, without significant interruptions.

Sustained Movement: Trends can last for various durations, from short-term trends that last for days to longer-term trends that span months or even years. The duration of a trend depends on the strength of the underlying factors driving it.

Causes of Trends: Trends can be driven by a wide range of factors, including economic data releases, geopolitical events, company earnings reports, changes in interest rates, supply and demand imbalances, and investor sentiment.

Identification: Traders and investors use various tools and techniques to identify trending markets. These include trendlines, moving averages, trend indicators, and chart patterns.

Trading Opportunities: Traders often seek to capitalize on trending markets by adopting different trading strategies. For example, during an uptrend (bullish trend), traders may look for opportunities to buy, while during a downtrend (bearish trend), they may consider short-selling or selling their existing positions.

Risk Management: Trading in trending markets can be profitable, but it also carries risks. Effective risk management strategies, such as setting stop-loss orders, are crucial for limiting potential losses if the trend reverses.

Market Sentiment: Sentiment plays a significant role in trending markets. Positive sentiment can fuel bullish trends, while negative sentiment can drive bearish trends. News, social media, and market sentiment indicators can provide insights into the prevailing sentiment.

Volatility: Trending markets can exhibit varying levels of volatility. High volatility can lead to rapid price movements, which can present both opportunities and risks for traders.

It's important to note that not all price movements qualify as trends. Sometimes, markets can trade in a sideways or range-bound fashion, where prices move within a relatively narrow range without a clear trend. Traders and investors use technical and fundamental analysis to differentiate between trending and non-trending market conditions.

In summary, a trending market is characterized by a sustained and consistent directional movement in asset prices, driven by various factors. Traders and investors pay close attention to trends in order to make informed decisions and implement suitable strategies to profit from price movements while managing risks.

Understanding Trending Markets

Understanding trending markets is crucial for traders and investors, as it can help them make informed decisions and implement effective strategies. Here are some key points to help you understand trending markets:

Identification of Trends:

Use technical analysis: Traders often rely on technical indicators and chart patterns to identify trends. Common indicators include moving averages (e.g., simple moving averages or exponential moving averages), trendlines, and momentum oscillators (e.g., Relative Strength Index or RSI).

Visual cues: On a price chart, an uptrend is typically characterized by a series of higher highs and higher lows, while a downtrend consists of lower highs and lower lows. Sideways or range-bound markets lack a clear directional bias.

Types of Trends:

Bullish Trend (Uptrend): In a bullish trend, prices are rising, and there is an overall positive sentiment in the market. Traders look for buying opportunities during such trends.

Bearish Trend (Downtrend): A bearish trend is marked by falling prices and negative market sentiment. Traders may consider selling short or exiting long positions during downtrends.

Sideways Trend (Range-bound): In a sideways trend, prices move within a relatively narrow range with no clear upward or downward direction. Traders often employ range-bound strategies to profit from price fluctuations within the range.

Factors Driving Trends:

Economic Data: Economic indicators, such as GDP growth, employment numbers, and inflation, can influence market trends.

Geopolitical Events: Political developments, trade tensions, and geopolitical crises can impact market sentiment and drive trends.

Corporate Earnings: Earnings reports and financial performance of companies can lead to stock price trends.

Interest Rates: Central bank decisions on interest rates can affect currency and bond markets.

Supply and Demand: In commodities and cryptocurrencies, changes in supply and demand dynamics can result in price trends.

Duration of Trends:

Trends can be short-term (days or weeks), intermediate-term (several months), or long-term (years). The duration depends on the underlying drivers and market conditions.

Trading Strategies:

Trend Following: Traders may employ strategies like trend following, where they buy or hold positions in the direction of the trend. This strategy aims to capture profits as the trend continues.

Counter-Trend: Counter-trend traders take positions against the prevailing trend, looking for reversal points. This strategy can be riskier but may yield significant profits if a trend reversal occurs.

Breakout Trading: Breakout traders look for opportunities when prices break out of established ranges, anticipating that a new trend may emerge.

Risk Management:

Implement risk management measures such as stop-loss orders to limit potential losses if a trend reverses.

Diversify your portfolio to spread risk across different assets and sectors.

Market Sentiment:

Monitor market sentiment through news, social media, and sentiment indicators. Sentiment can influence and reinforce trends.

Continuous Analysis:

Trends can change, and it's essential to regularly assess their strength and sustainability using technical and fundamental analysis.

Remember that while trending markets can present opportunities for profit, they also carry risks. Traders and investors should have a clear strategy, adhere to risk management principles, and stay informed about market developments to navigate trending markets effectively.

Identifying a Trending Market

Identifying a trending market is a crucial skill for traders and investors. Recognizing a trend early can help you make informed trading decisions and potentially profit from price movements. Here are some methods and indicators you can use to identify a trending market:

Price Charts: Analyzing price charts is one of the most fundamental ways to identify trends. Look for the following patterns on a price chart:

Higher Highs and Higher Lows (Uptrend): In an uptrend, each high is higher than the previous one, and each low is also higher than the previous low.

Lower Highs and Lower Lows (Downtrend): In a downtrend, each high is lower than the previous high, and each low is also lower than the previous low.

Sideways or Range-Bound: In a sideways or range-bound market, prices move within a relatively narrow horizontal range with no clear upward or downward trend.

Moving Averages: Moving averages are technical indicators that smooth out price data and help identify trends. Two common types of moving averages are:

Simple Moving Average (SMA): SMA provides an average of closing prices over a specific period. When prices are above the SMA, it can indicate an uptrend, and when below, it can suggest a downtrend.

Exponential Moving Average (EMA): EMA gives more weight to recent prices, making it react faster to price changes. Traders often use EMAs to identify shorter-term trends.

Trendlines: Drawing trendlines on a price chart can help visualize trends. Connect the lows in an uptrend and the highs in a downtrend to create trendlines. If the price consistently follows the trendline, it confirms the trend.

Trend Indicators: Various technical indicators are designed to identify trends. Some popular trend indicators include:

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that helps traders identify the strength and direction of a trend.

Relative Strength Index (RSI): RSI measures the speed and change of price movements and can indicate whether an asset is overbought or oversold.

Average Directional Index (ADX): ADX measures the strength of a trend. High ADX values indicate strong trends.

Volume Analysis: Analyzing trading volume can provide clues about the strength of a trend. In a healthy trending market, trading volume often confirms the direction of the trend. For example, increasing volume during an uptrend can suggest strong buying interest.

Fundamental Analysis: In addition to technical analysis, consider fundamental factors that might be driving a trend. For example, if a company is reporting strong earnings growth, it may contribute to a bullish trend in its stock price.

News and Events: Stay informed about news and events that could impact the asset you're trading. Economic reports, geopolitical developments, and company news can influence trends.

Market Sentiment: Monitor market sentiment through sources like social media, news sentiment indicators, and surveys of market participants. Positive sentiment can fuel uptrends, while negative sentiment can drive downtrends.

Confirmation: It's important to seek confirmation from multiple indicators and analysis methods. One indicator or pattern alone may not be sufficient to confirm a trend.

Remember that trends can change, and false signals can occur. Continuously monitoring the market and adjusting your trading strategy as needed is essential to successfully trade in trending markets. Additionally, risk management techniques, such as setting stop-loss orders, are crucial to limit potential losses in case a trend reverses.

Read more: https://computertricks.net/trending-market-what-it-means-how-it-works/

0 notes

Text

Procter & Gamble Co. (NYSE: PG) facilitates the provision of branded consumer packaged goods. Operating through segments like Beauty, Grooming, Health Care, Fabric and Home Care, Baby, Feminine, and Family Care. How Did the Company Increase Its Sales Growth During the recent quarter, P&G experienced a slight growth of 5.32%. Along with the sales, the firm saw a significant rise in its gross margin, which grew by 14% on a year-on-year basis. The report revealed that this growth was experienced due to the company’s plan to pass on the Cost of Goods Sold (COGS) to the end customers. This growth continued till the net profit, resulting in the company’s earnings per share (EPS) growth of 13% to reach $1.37. Following this above strategy, the management is projecting a 6% to 9% increase in EPS growth for the financial year 2024. The Brilliance of Management With a growth in the net profit, Return on equity is also at a significant level of 31.3%. Along with it, the company is earning a 20% return on the capital it has been investing. It means every 3.6 years, it doubles the capital returns. The financial management’s brilliance provides such returns while distributing over 62% of the net profits as dividends. It makes up a yield of 2.43% on the average stock price this year. Technical Analysis and Prediction of the PG Stock Price The PG stock price has just fallen after breaking a bullish trend in September as the bears reclaimed the resistance level of $152. The trend has slowed as the bulls have reclaimed the support level of $142. The current stock price is $143, just above the support level. The 50-day exponential moving average is $150, while the 150-day exponential moving average price is $14. On the other hand, the Relative strength index is at the oversold level of 26, indicating that the bears have a high buying pressure. The PG stock price prediction is bullish, as suggested by the RSI and current support level. The target price will be at $151, which is the zone of the immediate resistance. However, if things go south, the support will be broken, and the next target will be $136 Conclusion Procter & Gamble Co. (NYSE: PG) has experienced gross margin growth due to some decisions taken by their management. This growth has also benefited shareholders as the EPS and ROE have increased. The PG stock price broke a trendline and fell to its current support level. The price prediction, however, is bullish with a specific target price. Technical Levels Support: $142, and $136 Resistance: $152, and $157

0 notes

Text

The Fibonacci Extension Secret: Unlocking Hidden Profits in CAD/NZD The Market’s Best-Kept Secret: Why Fibonacci Extensions Matter in CAD/NZD If Fibonacci retracements are the “vanilla ice cream” of technical analysis, Fibonacci extensions are the rich chocolate drizzle that traders often forget about. And let’s be real—why stop at vanilla when you can have both? Especially when trading the Canadian Dollar (CAD) against the New Zealand Dollar (NZD), where market swings often defy the conventional wisdom of standard retracements. Understanding Fibonacci extensions in the CAD/NZD pair isn’t just about drawing some mystical lines on your chart and praying for profits—it’s about leveraging advanced price projection techniques to get ahead of the herd. In this article, we’ll uncover little-known Fibonacci extension strategies, break down why the CAD/NZD market is uniquely suited for this tool, and share expert insights to help you identify high-probability trade setups. Why Most Traders Get It Wrong (And How You Can Avoid It) Many traders assume Fibonacci extensions are just an extra step for mapping price targets, but in reality, they reveal the market���s underlying structure. When used correctly, they provide: ✔ Hidden Resistance and Support Levels – Price often reverses at extension levels that most traders completely ignore. ✔ Confluence Signals – When an extension aligns with other indicators like moving averages, support/resistance zones, or trendlines, it confirms a strong trade setup. ✔ Advanced Risk-Reward Optimization – Extensions help traders set more precise profit targets instead of using arbitrary levels. Yet, most traders just slap on a Fibonacci extension tool, set it to 1.618, and call it a day. That’s like trying to cook a gourmet meal with only salt and pepper—technically possible, but why not use the full spice rack? The Fibonacci Extension Playbook for CAD/NZD Step 1: Understanding CAD/NZD’s Unique Volatility Unlike major currency pairs like EUR/USD, CAD/NZD moves in a wildly independent fashion—often ignoring broader market trends. This is because: - Commodity Correlation: CAD is influenced by oil prices, while NZD is highly dependent on dairy exports. Supply chain disruptions in either sector can cause sudden trend shifts. - Thin Liquidity: Unlike highly liquid pairs, CAD/NZD experiences sharper price movements, making Fibonacci extension projections even more effective. Step 2: Choosing the Right Fibonacci Extension Levels The standard Fibonacci extensions are 1.272, 1.414, and 1.618. But if you want the next-level trader advantage, you should also watch these “underground” levels: - 2.0 (Double the move) – Often used by institutional traders. - 2.618 (Exponential Breakout) – When price breaks beyond this level, a parabolic rally or drop is often underway. - 3.618 (Extreme Target) – Best used for high-volatility news-driven movements. Step 3: Spotting the Perfect CAD/NZD Fibonacci Setup Now, let’s break down a proven, high-probability trade setup using Fibonacci extensions: 1️⃣ Identify the latest swing high and swing low—these act as your base levels. 2️⃣ Use the Fibonacci extension tool and plot it from the swing low to swing high (or vice versa). 3️⃣ Wait for price to break through 1.272 or 1.618 and confirm the move with a secondary indicator (like RSI or MACD). 4️⃣ If price retests the 1.618 level and holds, enter a trade targeting the 2.0 or 2.618 extensions. 5️⃣ Set stop-loss just below the last structural low (for buys) or above the last structural high (for sells). The Forgotten CAD/NZD Strategy: Combining Fibonacci Extensions with Market Sentiment While Fibonacci extensions give you the “where” of price movement, understanding market sentiment tells you “why” it happens. Here’s a next-level trick: 📉 When retail traders are overly bullish, price often fails to hit the 1.618 extension. Instead, look for price exhaustion at 1.272 and a potential reversal. 📈 When institutional traders dominate, price tends to blast through 1.618 and aim for 2.0 or higher. Case Study: How a 2.618 Extension Predicts CAD/NZD Trend Reversals Let’s take a real-world example: 📌 On January 2024, CAD/NZD was in a strong bullish trend following a rise in oil prices, driving CAD higher. Using Fibonacci extensions, traders identified a 1.618 target at 1.1175. However, price blew past that level and hit 2.618 at 1.1350, where it faced heavy resistance and reversed. Had you been aware of the 2.618 level, you could’ve secured profits before the big banks started dumping their positions. Final Thoughts: Why Fibonacci Extensions are a Must-Have in Your CAD/NZD Strategy Mastering Fibonacci extensions isn’t just about drawing fancy lines—it’s about understanding where smart money enters and exits. If you apply these techniques correctly, you’ll start spotting high-probability setups before the crowd catches on. To take your trading even further, check out these exclusive tools: 🔥 Get real-time Forex insights: Forex News Today 📚 Deepen your knowledge: Free Forex Courses 👨🏫 Join an elite trading community: StarseedFX Community 📝 Optimize your trade execution: Smart Trading Tool —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Akash Network price outlook: can bulls push for $1?

Akash Network, a decentralized marketplace for cloud computing, has seen the price of its native token AKT jump by more than 12% in the past 24 hours. While the resistance level at $0.70 remains key for bears, bulls’ sharp bounce over the past day has AKT trading in a positive trend. With altcoins also mirroring Bitcoin’s trajectory, the latest upsurge could be the base for a fresh attempt at recapturing the coveted $1.00 level. Akash Network price prediction Selling pressure saw AKT lose the important $1.00 level in May 2022, with lows of $0.22 reached in May this year. Since then, bulls have hit the $0.75 zone twice in the past two months. However, rejection at the level meant a retest of support at $0.50 in mid-July. Prices have however remained above an ascending trendline support, suggesting bulls are still determined to reclaim the upper hand. If price breaks above $0.75, it could go on to retest the supply wall expected at $1.00. Part of the Akash Network’s bullish momentum is likely to come from the launch of its Akash GPU mainnet. After successfully navigating the testnet in May, with multiple AI models tested on the NVIDIA A100, Akash moved a step closer to offering the first open-source marketplace for HD GPUs. NVIDIA H100s remain in record-high demand, but distribution is still limited and inefficient. The launch of the Akash GPU Mainnet is almost here, which will create the first open-source marketplace for high-density GPUs. The world is ready for the #AISupercloud. https://t.co/y6OTupy9iZ — Akash Network (@akashnet_) August 3, 2023 Excitement for what could be AI Supercloud, fueled by massive predictions for the artificial intelligence industry, will likely cascade into the AKASH market. Akash Network price chart. Source: TradingView The daily RSI indicates that momentum remains with the bulls, a scenario likely to be helped by a strengthening of the MACD indicator. Also key is the continued support of the 50-day exponential moving average, currently providing a base at $0.57. The post Akash Network price outlook: can bulls push for $1? appeared first on CoinJournal. Read the full article

0 notes

Text

Grayscale’s victory boosts market; Bitcoin, Ethereum breakout from bearish pattern.Ethereum’s buying and selling quantity spikes by 151%, reaching $11.4B in 24H.Within the midst of a bear market, a glimmer of hope emerges with current information concerning Grayscale Investments, a crypto asset supervisor. It has achieved a big victory in opposition to the USA Securities and Change Fee (SEC) in its pursuit to remodel the Grayscale Bitcoin Belief (GBTC) right into a publicly listed Bitcoin exchange-traded fund (ETF). This growth has catalyzed a 4.32% surge within the crypto market over the previous 24 hours, propelling main cash like Bitcoin and Ethereum to interrupt free from their extended bearish developments. Impressively, each Bitcoin and Ethereum have surged by 5.56% and 4.63%, respectively, inside the final 24 hours.Delving into the background, the SEC beforehand rejected Grayscale’s GBTC software in October 2021, citing issues about insufficient safeguards in opposition to fraudulent and manipulative practices. Grayscale responded with a lawsuit, resulting in a positive overturning of the choice.In a big flip of occasions on August 29, U.S. Court docket of Appeals Circuit Decide Neomi Rao granted Grayscale’s petition for evaluation. And vacated the SEC’s denial of the GBTC itemizing software. Decide Rao had earlier criticized the SEC for missing rationalization in its stance in opposition to Grayscale. Nevertheless, it’s essential to notice that this order doesn’t assure the eventual itemizing of a Grayscale spot Bitcoin ETF.When will ETH hit $2000 ?Because the deadline for the approval of Bitcoin and Ethereum ETFs approaches, the market sentiment stays bullish, injecting hope into the times forward. For Ethereum, regardless of dealing with its lowest worth vary since Q2 of the 12 months, with worth oscillating between $1650 and $1698, the current bullish resurgence after a month-long battle in opposition to bears fell in need of pushing the worth past $1800. Nevertheless, the prevailing optimistic momentum and the potential approval of ETFs recommend a powerful chance of the worth surpassing $2000 and even hovering above $2000.Ethereum’s buying and selling quantity has surged by a formidable 150.75% previously 24 hours, reaching $11.4 billion. On a unique notice, the entire each day transaction charges on the Ethereum community dropped to 1,719 ETH ($2.8 million). It occurred on Sunday, the bottom since December 26, in line with CryptoQuant. This marks an 89% lower from the year-to-date peak noticed on Could 5.Will The Bulls Maintain its Crown?An evaluation of Ethereum’s current worth actions underscores a prevailing bullish pattern on the each day chart. The short-term 9-day exponential transferring common (EMA) presently sits at $1688, indicating ongoing bullish sentiment. In the meantime Ethereum is presently priced at $1715. The Relative Power Index (RSI) stands at 46, signifying a impartial zone.Ethereum (ETH) Each day Value Chart (Supply: TradingView)Ought to the SEC green-light the Bitcoin ETF on Monday, Ethereum’s worth might breach essential EMAs. And doubtlessly retest the beforehand damaged help trendline. This optimistic momentum may propel the uptrend to cross the $2000 mark, concentrating on the prior swing excessive of $2140.Conversely, if the SEC opts for a call delay, the worth of Ethereum may retreat to the $1600 demand zone.Will ETH Maintain its Bullish Strain? Share your ideas by tweeting us at @The_NewsCryptoSupply: https://thenewscrypto.com/will-ethereum-cross-2k-amidst-positive-momentum/

0 notes

Text

XRP price can fall 40% by September — Fractal analysis

The double-digit percentage gains for XRP (XRP) this month may have reached an exhaustion point, reflecting the trends elsewhere in the cryptocurrency market. This follows the euphoria surrounding Ripple’s partial win against the United States Securities and Exchange Commission, resulting in bullish calls for as high as $15 in the coming months. $15 is reasonable I believe over 18 months or so. If they IPO and time it correctly, could be up to $35 imo. Make no mistake… it may not go that high… but $XRP IS breaking an all time high this cycle save some sort of pointless, vindictive SEC appeal. (Low chance) https://t.co/rrMCuOacrE — Ben Armstrong (@Bitboy_Crypto) July 19, 2023 Nonetheless, fractal analysis of XRP’s recent candlestick and price momentum patterns hints that a sharp market correction is not off the table, particularly if history repeats. XRP price fractal preceded 65% decline Notably, certain XRP market signals preceded a 65% price decline in Q2 2021. These are now flashing again, namely the multiyear descending trendline resistance and an “overbought” relative strength index (RSI), as illustrated below. XRP/USD weekly price chart. Source: TradingView The descending trendline resistance (marked as “upper trendline resistance” in the chart above) has limited XRP’s upside since January 2018. This price ceiling is helped by another horizontal trendline resistance (purple) near $0.93. Overall, the resistance confluence, coupled with an overbought RSI, now raises XRP’s risks of a market correction. In this case, XRP price will likely fall toward the lower trendline support near $0.52 by September, down almost 40% from current price levels. Related: Chair Gensler says SEC reaction to Ripple decision is mixed, still under consideration Interestingly, the downside target appears closer to XRP’s 50-week exponential moving average (50-week EMA; the red wave), which raises the possibility of a bounce around this level. Moreover, the wave support was the local bottom level during the price decline in Q2 2021. As of July 20, Ripple price is up 70% month-to-date, outperforming the broader crypto market, which rose only 5% in the same period. This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Source link Read the full article

0 notes